Description

Table of Contents

Expert Financial Feasibility Report by Projectzo

In today’s competitive business landscape, making informed decisions is paramount to success. A comprehensive Financial Projection Report is not just a document; it’s a roadmap to your business’s future, providing clarity and direction. At Projectzo, with over 15 years of trusted expertise, we specialise in delivering meticulous Financial Feasibility Study and Finance Forecast Report services that empower businesses to navigate the complexities of financial planning with confidence.

Understanding the Importance of a Financial Feasibility Report

A Financial Feasibility / Projection Report is a crucial tool for any business, whether you’re a startup seeking funding or an established enterprise planning for expansion. It provides a detailed forecast of your company’s future financial performance, encompassing projected income statements, balance sheets, and cash flow statements. This Financial Forecast Report is essential for:

- Securing Funding: Investors and lenders require a robust financial projection to assess the viability of your business and their potential return on investment.

- Strategic Planning: It helps in setting realistic goals, allocating resources effectively, and making strategic decisions about growth and expansion.

- Business Planning: A well-prepared financial projection is a cornerstone of a comprehensive business plan, demonstrating the financial viability of your venture.

- Performance Benchmarking: It provides a benchmark against which you can measure your actual financial performance and make necessary adjustments.

Our Premier Service: Financial Projection and Feasibility Studies

Comprehensive Financial Projection Reports

At Projectzo, we go beyond mere number-crunching. Our team of seasoned financial analysts utilizes advanced financial modeling techniques to create a Financial Projection Report that is both accurate and insightful. We analyze key financial metrics, including revenue streams, cost structures, profit margins, and cash flow patterns, to provide a holistic view of your financial future.

Our reports typically include:

- Projected Income Statements

- Pro-forma Balance Sheets

- Cash Flow Projections

- Breakeven Analysis

- Sales Forecasts

- Expense Budgets

In-depth Financial Feasibility Study

Before embarking on a new project or venture, a thorough Financial Feasibility Study is indispensable. This study assesses the economic viability of a proposed project, helping you to understand the potential risks and rewards. Our experts at Projectzo conduct in-depth feasibility studies that cover:

- Market Analysis: Understanding the market size, competition, and pricing strategies.

- Initial Investment Analysis: Evaluating the required initial investment and funding sources.

- Risk Analysis: Identifying and assessing potential financial risks and developing mitigation strategies.

- Return on Investment (ROI): Projecting the potential return on your investment to guide your decision-making.

Why Choose Projectzo? Your Trusted Partner in Financial Forecasting

With a legacy of excellence spanning over 15 years, Projectzo has established itself as a trusted name in the financial consulting industry. Our commitment to quality, accuracy, and client satisfaction sets us apart.

- 15+ Years of Trusted History: Since our inception in 2010, we have been providing top-notch financial consulting services to a diverse clientele.

- Expert Team: Our team comprises experienced financial analysts with a deep understanding of various industries.

- Tailored Solutions: We understand that every business is unique. That’s why we offer customized solutions tailored to your specific needs and objectives.

- Advanced Financial Modeling: We leverage cutting-edge financial modeling techniques to deliver precise and reliable financial projections.

- Actionable Insights: Our reports are not just a collection of data; they provide actionable insights that empower you to make informed decisions for sustainable growth.

Flexible Tenure Options for Your Financial Feasibility Report

We offer a range of tenure options for our financial feasibility reports to suit your specific project requirements.

Get Your Comprehensive Financial Forecast Report Today!

Don’t let financial uncertainty hold your business back. Partner with Projectzo for a comprehensive Financial Feasibility Report that will provide you with the clarity and confidence to achieve your business goals.

FAQs

Think of it this way: if a business plan is the dream, the Financial Feasibility Report is the proof that the dream is profitable. It’s the culmination of a deep financial feasibility analysis and rigorous financial forecasting.

As a leader, you must understand this: a business plan sells the vision, but this report validates its financial foundation. It’s the critical document that transforms your ideas into a credible financial narrative, making it an indispensable tool for strategic decision-making and attracting investment.

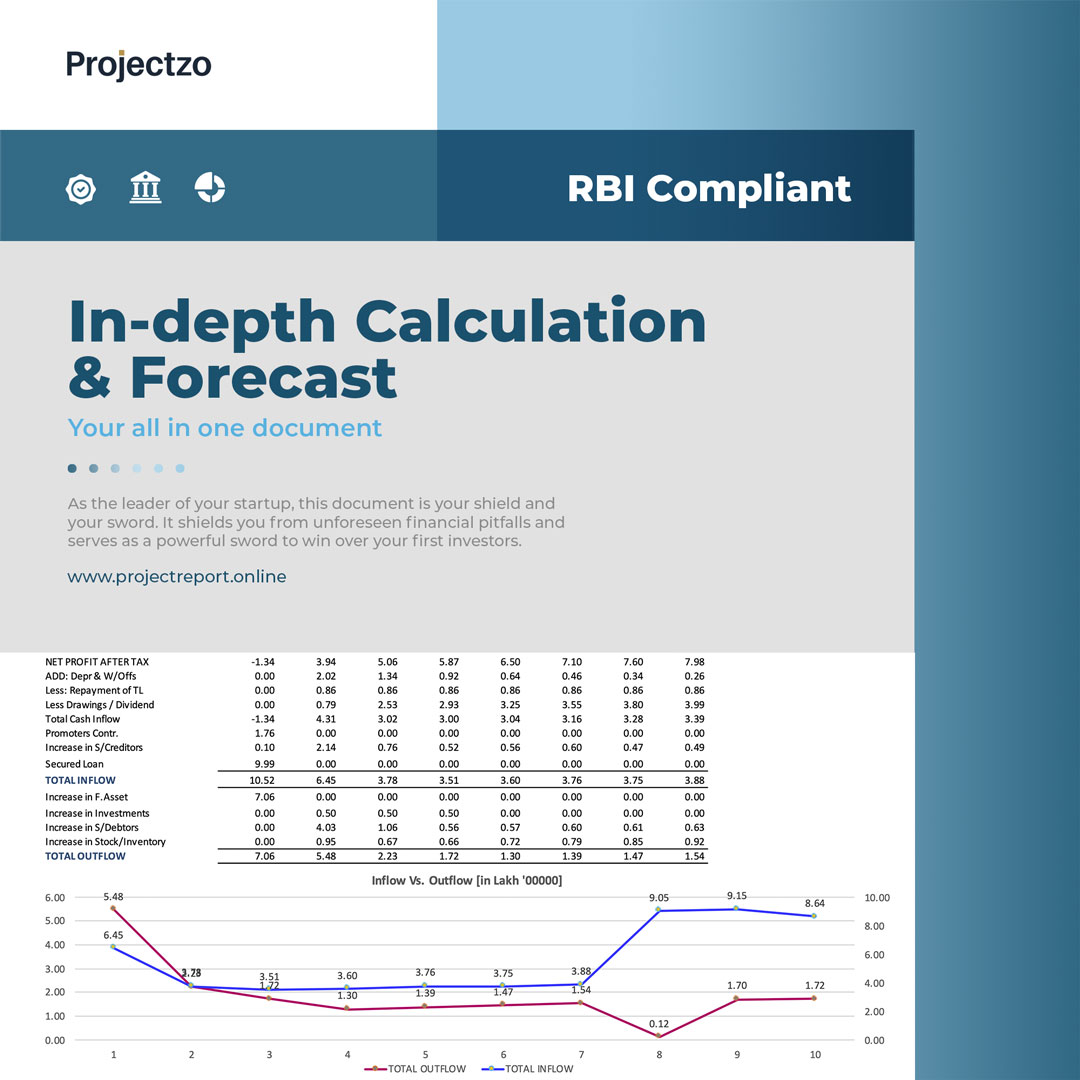

Let’s demystify the process. A financial feasibility study is a structured investigation into your business’s financial potential. At its core, we focus on creating a detailed financial projection, which includes two key deliverables:

A multi-year cashflow projection to anticipate the flow of money in and out of your business.

Projecting a balance sheet to show the future financial health and net worth of the company.

This isn’t just about numbers; it’s about building a dynamic financial model. It’s a leadership tool that allows you to foresee challenges and make proactive decisions based on a solid cash flow prediction.

A great report tells a convincing financial story. The non-negotiable ingredients are a robust financial feasibility analysis that includes: A great report tells a convincing financial story. The non-negotiable ingredients are a robust financial feasibility analysisthat includes:

- A realistic projected balance sheet, which bankers will scrutinize to assess your asset and liability structure.

- Accurate cashflow projections, as this demonstrates your ability to manage liquidity and meet obligations.

Think of a cash flow statement example as a foundational learning tool; we move beyond the example to create a bespoke, forward-looking model for your specific venture. This comprehensive financial feasibility assessment is what separates a document that gets filed from one that gets funded.

Bankers need confidence, and confidence comes from clarity. We ensure your report aligns with the expected project report for bank loan format, translating your vision into the language they trust. It’s not just a request for money; it’s a clear demonstration of viability.

A key part of this is showing a strong, positive cashflow projection. When a lender sees you have a meticulous plan for managing your cash and a clear understanding of your future financial position through a projected balance sheet, their perceived risk plummets, making “Yes” the logical conclusion.

Viewing this as a mere expense is a critical mistake. The report is an investment in certainty. Consider the cost of launching a business based on a flawed cash flow prediction—it could be catastrophic. This report is like your financial insurance policy.

A leader understands that the cost of not performing a proper financial feasibility assessment is infinitely higher. It’s about investing a little upfront to protect your entire capital investment. The ROI is confidence, risk mitigation, and a vastly improved chance of securing funding.

The primary goal of financial forecasting within a feasibility study is to create a credible roadmap of your financial future. It’s not about predicting the future with a crystal ball; it’s about using realistic assumptions to model likely outcomes.

This process provides the core data for your cashflow projections and balance sheets. For a leader, strong financial forecasting is everything. It allows you to set realistic goals, manage resources effectively, and navigate your business toward profitability with a clear line of sight.

A projected balance sheet is a snapshot of your company’s future financial health. While cash flow shows the movement of money, the balance sheet reveals your long-term stability and worth by detailing your assets, liabilities, and equity.

Investors and lenders look at this to answer critical questions: Will the company be building valuable assets? Is the debt level manageable? Is the owner’s equity growing over time? Mastering the art of projecting a balance sheet is a key leadership skill, demonstrating you’re building a business with lasting value.